top of page

ETI is Not a Tax Deduction: It's a Monthly PAYE Refund

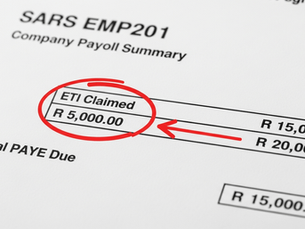

Many businesses misunderstand the Employment Tax Incentive (ETI). It is not a tax deduction you claim at year-end like Section 12H. The ETI is a direct, monthly subsidy from the government designed to encourage youth employment. It functions as a cash-back mechanism that reduces your company's monthly PAYE tax liability . You claim it directly on your monthly EMP201 submission to SARS. If your ETI claim is larger than your PAYE bill, the extra amount can be refunded to you.

Lune Henderson

Nov 52 min read

The R100,000 Learnership That Costs You R22,500: An Intro to "Incentive Stacking"

What if your B-BBEE Skills Development spend wasn't just a compliance cost, but one of your smartest financial strategies? Many South African businesses fail to realize that the government has created a powerful framework of layered incentives that, when "stacked" together, can dramatically reduce the net cost of a learnership to almost zero. This "incentive stacking" combines benefits from SETA grants, SARS tax allowances, and PAYE subsidies for a single learner. At White Pa

Lune Henderson

Oct 272 min read

bottom of page