top of page

The "Double Deduction": How the Section 12H Learnership Allowance Really Works

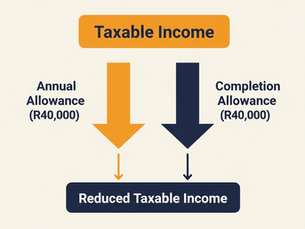

The Section 12H Learnership Allowance is one of the most powerful financial incentives for South African employers. Its power lies in a "double deduction" feature: it is an additional tax deduction, claimed over and above the normal deductions for employee wages and training costs. This directly reduces your taxable income, resulting in a substantial tax saving. To claim it, you must have a formal learnership agreement registered with the relevant SETA. The allowance is comp

Lune Henderson

Nov 32 min read

The R100,000 Learnership That Costs You R22,500: An Intro to "Incentive Stacking"

What if your B-BBEE Skills Development spend wasn't just a compliance cost, but one of your smartest financial strategies? Many South African businesses fail to realize that the government has created a powerful framework of layered incentives that, when "stacked" together, can dramatically reduce the net cost of a learnership to almost zero. This "incentive stacking" combines benefits from SETA grants, SARS tax allowances, and PAYE subsidies for a single learner. At White Pa

Lune Henderson

Oct 272 min read

How Are Learners Free? Understanding the Learnership Funding Model

One of the first questions we get from business owners is, "What’s the catch? How can learners work in my business at no salary cost?". It’s a logical question. In business, if something sounds too good to be true, it often is. However, in this case, the answer lies in a powerful, government-backed system designed to boost skills development across South Africa. There is no catch—just a smart model you can leverage for your business. The Power of Accredited Learnership Grants

Lune Henderson

Oct 202 min read

bottom of page