top of page

ETI is Not a Tax Deduction: It's a Monthly PAYE Refund

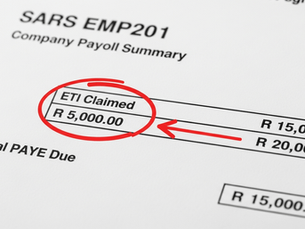

Many businesses misunderstand the Employment Tax Incentive (ETI). It is not a tax deduction you claim at year-end like Section 12H. The ETI is a direct, monthly subsidy from the government designed to encourage youth employment. It functions as a cash-back mechanism that reduces your company's monthly PAYE tax liability . You claim it directly on your monthly EMP201 submission to SARS. If your ETI claim is larger than your PAYE bill, the extra amount can be refunded to you.

Lune Henderson

Nov 52 min read

bottom of page