top of page

The "Double Deduction": How the Section 12H Learnership Allowance Really Works

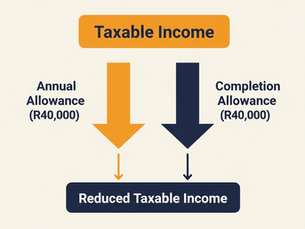

The Section 12H Learnership Allowance is one of the most powerful financial incentives for South African employers. Its power lies in a "double deduction" feature: it is an additional tax deduction, claimed over and above the normal deductions for employee wages and training costs. This directly reduces your taxable income, resulting in a substantial tax saving. To claim it, you must have a formal learnership agreement registered with the relevant SETA. The allowance is comp

Lune Henderson

Nov 32 min read

bottom of page