top of page

ETI is Not a Tax Deduction: It's a Monthly PAYE Refund

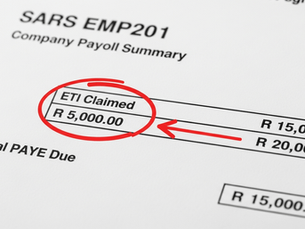

Many businesses misunderstand the Employment Tax Incentive (ETI). It is not a tax deduction you claim at year-end like Section 12H. The ETI is a direct, monthly subsidy from the government designed to encourage youth employment. It functions as a cash-back mechanism that reduces your company's monthly PAYE tax liability . You claim it directly on your monthly EMP201 submission to SARS. If your ETI claim is larger than your PAYE bill, the extra amount can be refunded to you.

Lune Henderson

Nov 52 min read

The B-BBEE "Triple Penalty": Why Missing Your WSP/ATR Deadline is a Catastrophic Error

For South African businesses, the annual B-BBEE verification cycle is filled with complex targets. But no deadline is more critical, or more dangerous to miss, than the 30 April submission of your Workplace Skills Plan (WSP) and Annual Training Report (ATR) to your relevant SETA. Failing to meet this single deadline is not a minor administrative slip-up; it is a catastrophic commercial error that triggers a devastating chain of consequences known as the "triple penalty". The

Lune Henderson

Oct 242 min read

bottom of page